Now, more than ever, money is tight. Debts are piling up, groceries are getting more expensive, and you feel like you’re barely keeping your head above water. Thankfully, there’s one trick to saving more money that’s free, simple, and only requires a bit of pre-planning: a no buy month.

Your first no buy month (also called a no spend month or a spending freeze) can be quite a challenge. So today, I’ll walk you through all the ins and outs, using what I’ve learned the hard way during my own experiences. We’ll talk about what a no buy month is, who should consider trying one, and when to plan yours. I’ll also share all my best tips and tricks I’ve learned from experience so you can be successful the first time around.

What’s a no buy month?

A no buy month is a kind of savings challenge where you don’t spend any unnecessary money for a whole month. They can look very different from person to person, depending on what you consider “unnecessary.”

Some people might choose to just limit spending from one particular store or budget category for their no buy month. No Amazon, no makeup or hobby supplies, no eating takeout, etc. This is most common for people during their first no buy challenge.

Others might take it further and not spend money on anything except essential bills, grocery shopping, and/or debt payments. This is common for those doing a no buy month for the second or more time, or who REALLY need to rein in all areas of spending.

If you want a full run-down of the rules of a no buy month (also sometimes called a “no spend” challenge), I wrote a separate article to cover them in much more detail.

Why try a no buy month?

The most obvious reason to stop spending money for a time is to pile up cash. At the end of your month, you might plan on throwing all of the money you’ve saved at a specific debt. Alternatively, you might be saving up for a big expense like a car repair, Christmas presents, or a vacation. But money isn’t the only reason to freeze your finances for a time.

A no buy month also great for helping you understand WHY you want to spend. When spending money is no longer an option, you notice the urge a lot more. This can be helpful!

Perhaps you notice you want to shop when you’re anxious, for example. This can help you target new strategies for managing that feeling.

Perhaps you realize one particular app on your phone gives you the urge to splurge. You might decide to hide or even delete that like couponing, meal delivery, or specific store’s app to reduce the urge and save more money.

Who should try a no buy month?

No buy months aren’t for everyone. For example, someone who already tracks every penny they spend likely won’t save much money by halting their spending. Likewise, very self-aware people who have no blind spots emotionally won’t learn much about their habits with a no buy month.

So who should try a no spend challenge?

- People with irregular income. Anyone who relies on tips or owns their own business might have wildly different paychecks from week to week. This means they could use a larger emergency fund. The money saved during a no buy month can carry them through the “light” months without taking on more debt.

- New graduates and young professionals. People who aren’t used to having so much money can be at risk for developing bad spending habits. Doing a no buy month at the beginning of a career can help them better understand their wants vs their needs. It can also help start good habits early.

- Anyone just starting a debt-free journey. One of the best ways to kick off your path to financial freedom is by getting rid of debt in record time. Getting a quick win from knocking out one smaller debt can give you a huge boost of motivation to keep going forward.

- Individuals aiming for specific financial goals. Whether you’re buying a home, starting a business, or having a baby, some big dreams need big cash behind them. Of course, most can’t save enough for a down payment during a single month. That shouldn’t stop you from getting the ball rolling though!

- Anyone feeling out-of-control with their money. For some, it’s less about the money and more about the feelings. No one should feel helpless against their own desires to spend, spend, spend. In this case however, you might benefit from also talking with a therapist about compulsive, addictive, or unwanted behaviors.

When should I do a no buy month?

Now! Maybe.

You see, the best part about “now” is that you clearly have some motivation to save. Probably because you either have exciting goals or are desperate to get out of your current financial spot.

However, some months are better suited to a no buy month than others.

The classic no buy month is often called “No Buy January.” Many people struggle financially in January after a holiday season of splurging and excess. “Get out of debt” is also a common New Year’s resolution. So January is the perfect time to tighten your financial belt.

The hardest no buy month for most is “No Spend November.” That one falls right before the big holiday spending season. It also includes Black Friday, the biggest sales day of the year. Planning a no buy month in November is challenging because you need to avoid all the financial expectations that come with holiday shopping and gatherings. Plus, there’s so much more advertising to avoid or be tempted by!

So when should you plan your no spend month? As soon as you can, but plan ahead for any big roadblocks. (See the “tips” section for ideas.)

Problems to avoid

During my own no buy months in the past, I’ve made a few mistakes I wanted to share. Hopefully, you can learn from my experiences and have a better first time.

Peer pressure

All too often, it’s our friends and family that can stop our no buy before it starts. Especially if you’re used to hanging out in restaurants and bars, spending on entertainment, or taking vacations, a no buy month can be confusing to the people around you.

Make sure you let those in your life know what you’re doing and why it’s important to you. You don’t need to describe your financial pit in detail if you don’t want to, though. A simple “I need to have better money habits” or “I need to save for [X goal] this month” should do the trick.

Also, feel free to take charge in planning free events during your no buy month! Plan a library-rented movie marathon, host a potluck, or grab some friends for frisbee in the park.

Cravings

Begin your no buy month with the guarantee that you’ll get a craving at least once. More likely, you’ll get lots of them. Make a plan now for how you’ll handle them.

For me, I avoided cravings for Dairy Queen by allowing myself to bake scratch brownies once I got home. They weren’t something I needed, but I didn’t spend any extra money to make them since I had all the ingredients. I called that a win!

Perhaps you’ll pick a certain person to text when you feel weak for accountability. Maybe you’ll journal your way through cravings or come up with a list of acceptable alternatives.

Pro-tip: if online shopping is your big weakness, a lot of people swear by the “put whatever you want into the checkout cart, but don’t actually hit buy button” trick. It scratches the itch to window shop, but without the payout at the end.

You quit after one slip up

If your month gets off to a rocky start quickly, many people might feel they’ve already failed. And if they failed, why bother continuing?

Don’t fall into that trap! After all, you can’t reach your savings goal or learn more about your spending habits without finishing the month, right?

So instead, see the spot where you slipped as a set of caution flags for the rest of the month. Was it Amazon shopping that you couldn’t resist? Treat Amazon like hot lava the rest of the month- avoid it altogether, and avoid whatever situations led to you even thinking about Amazon, too.

Unexpected emergencies

No matter how well you plan your no buy month, something can always come up.

If your car breaks down, you need to visit the ER, or God forbid someone dies, put the challenge on hold. You absolutely need to pay for emergencies when they happen.

Hopefully whatever you saved can go towards those emergency expenses. Good thing you were doing a no buy month. That money will help you avoid the debt you would have gone into if you’d never started!

Just make sure it’s a REAL emergency, and not “my kid is whining about getting new Air Jordans when his current shoes fit just fine.” Ask yourself if you can wait a few more days or weeks before tackling the new problem, or if you can get creative and solve the problem a different way.

Tips for a successful no buy month

Check the calendar

Does anyone have a birthday or anniversary coming up during your no buy month? How about any retirement parties, weddings, or baby showers you’ve committed to attending?

Make a plan ahead of time for how you want to handle gift-giving events. You can either buy all the necessary presents ahead of time, make these particular gifts a single exception to your no buy month rules, or try for something homemade.

Check your bank statement from last year

If you’re doing a No Buy January, grab last January’s bank statement. Did you sign up for any annual subscriptions that will auto-renew during your challenge? Make sure you plan ahead for these expenses, or cancel the subscriptions if you’re not using them.

The last thing you want is that feeling of failure when something unexpected gets charged during your challenge month. Plan ahead!

Practice breaking habits before

If Starbucks is your kryptonite, consider getting some home brewing practice in the month before your no buy month. This gives you a chance to work out some kinks (you need HOW much ground coffee for two people??) in a lower-pressure situation.

Save your money somewhere safe

If you struggle with spending every dime you make, you’ll want to protect the money you save this month so you don’t blow it.

If you’ll be saving mostly dollar bills or change, you might want a physical place that makes accessing money more difficult, like one of these piggy banks for grown ups that requires a password to open. Just make sure you have a trusted friend create the password, or make up something random and hide the code in a safe place! The best part about these password-protected banks is that they’re reusable (unlike the ‘break them to get the money’ banks). So you can do challenge after challenge!

If you’re more interested in saving money digitally, I’d suggest the Chime banking app. Chime offers savings accounts that automatically save a portion of your paycheck, so you’ll never even see the money in your checking account and think it’s available to spend.

Use the “Just Add One Step” method

If you’re currently Doordashing most of your meals in a week, consider loading up on ready-to-eat freezer meals or getting a meal subscription kit.

If you’re currently eating mostly heat-and-serve meals, try something a little more complicated like Hamburger Helper.

If you’re already using box mixes, try cooking fully from scratch!

Don’t try to become the next Guy Fieri during your no buy month if you don’t currently know how to boil water. Just add one step more to the cooking process than you currently use!

Track your progress

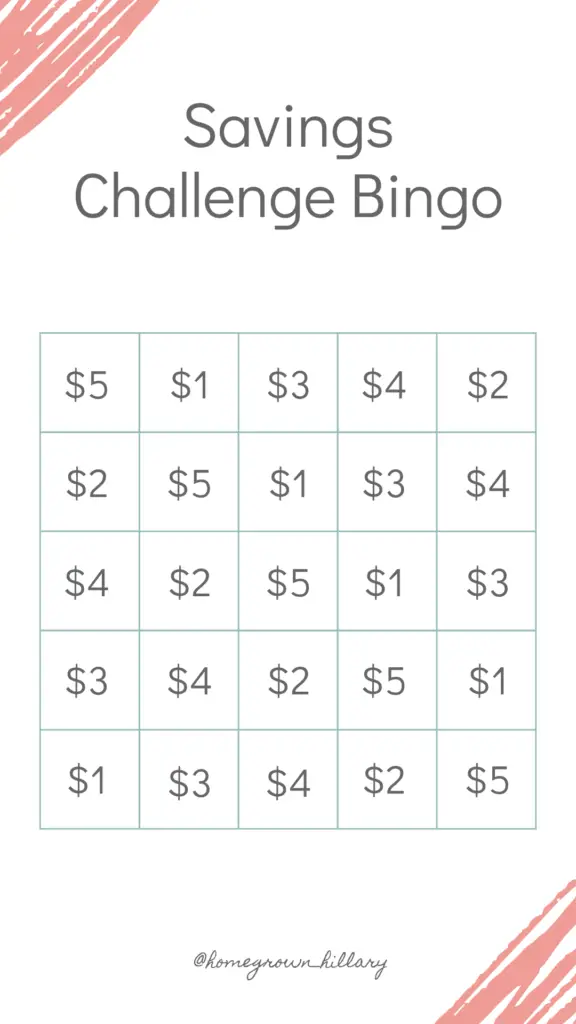

You will want to track how much money you save during your no buy month. This will this help motivate you to keep going!

You can track this by filling out savings trackers, if you like. I’ve written an article about expense trackers with free downloads, including the kinds below:

Or, you can keep track of how many times you DIDN’T go shopping, get McDonalds, visit the movies, etc. (Just make a tally mark every time you were invited somewhere or had a craving and resisted.) Then, at the end of the month, count how much all those tally marks would have cost you!

Clean your house.

I know, this one sounds weird. But you’ll likely be spending more time at home if you’re used to eating at restaurants or going out for entertainment a lot. You’ll have a harder time sticking to your no spend goals if your house mess stresses you out!

As a bonus, you can use a thorough house cleaning to take up the time you might otherwise spend shopping. And you’ll probably find useful things you forgot about, or items you can sell secondhand to further crush your savings goals.

If you want even MORE tips for no buy months, I also wrote a separate article dedicated to even more.

Ending a no spend month

First, celebrate! You had at least one small win sometime during the month, and that’s worth congratulating yourself over. Don’t go crazy with splurging (you just worked so hard!) and don’t blow all your money, but treat yourself with some small token or reward.

Next, evaluate how you did during your no buy. Ask yourself the following questions:

- Did you hit your savings goals?

- Did you learn anything about the ways you typically spend money?

- How hard was it to not spend?

- Were certain categories harder to avoid the temptation to buy?

Then, use your answers to guide you going forward. Start by making a written budget that prioritizes your goals and includes whatever “new normal” will look like for you.

If you saved a TON of money and decide it wasn’t as hard as you thought, perhaps you want to continue into a second no buy month.

If you didn’t save as much as you wanted, or if you really struggled with temptations, switch things up. There’s no sense hitting your head against a brick wall. If your income is too low, maybe you should try focusing on finding a side hustle or getting a promotion at your main job.

Alternatively, try really doubling down on not spending in just one category first, if you felt like not spending ANYWHERE was too hard to start with.

Regardless of how the month turned out, you took your first steps towards a more financially free future, and the next month is a chance to keep moving forward. You’ve got this!

That’s all for today! If you’d like to get more articles delivered straight to your inbox about saving money and raising a family on a budget, be sure to subscribe to my weekly email newsletter below!