When I was fresh out of college, I had zero understanding of how much money I spent. Groceries? I bought what I wanted! Clothes? Well, at least I used the thrift store. It wasn’t until I tried my first no spend month that I really understood how much I spent willy-nilly.

A no spend month (also called a no buy month) is a type of savings challenge where you try to make only the most essential purchases for a whole month. You can do a no buy month any time of year, but two popular ones are No Spend November and No Buy July.

If you’re trying to stop overspending, get out of debt, or stop eating out so much, a no spend month might be the missing breaks on your financial vehicle.

Today, I’m sharing some of my best no spend hacks, which I’ve discovered from making my own mistakes during previous no spend challenges. Follow along, and you’re guaranteed to have a better first attempt than I did!

1. Have a clear goal.

Before starting your month, it’s important to set some clear goals for yourself. Why are you even bothering with this no spend challenge? Are you trying to save money, reduce your consumption, or break a habit?

If you mostly just want to save money, are you trying to save a specific amount? If you’re trying to stop overspending, what categories do you want to rein in first? Write down whatever answers you come up with.

Finally, consider posting them somewhere you’ll see regularly, like a bathroom mirror or tucked into your wallet. Getting clear with yourself will help you stay motivated.

2. List your expenses.

One of the rules of a no spend month is usually to keep paying your bills. (Mortgage companies usually don’t accept “I was doing a no spend challenge” as a reason for missing payments!) Knowing how much you expect to spend on bills, even if it’s just an estimate for variable bills like groceries or utilities, is critical to hitting your savings goals for the month.

Here are some common expenses you might want to plan for:

- Mortgage/rent

- Utilities (water, sewer, electricity, gas, trash etc)

- Phone plan

- Car payment/public transportation fees

- Health insurance

- Car / home / life insurance

- Groceries

And don’t forget to think about whether you’ll have any irregular bills this month, like quarterly tax payments or annual subscription renewals. They might not happen every month, but if they absolutely need to get paid during your no spend month, you’d better plan for them.

3. Set specific rules.

Once you have a clear goal in mind, you can set some rules for yourself. For example, you might decide not to spend any money in specific categories such as clothes, takeout food, or entertainment.

Want to see a list of the top ten most common no spend month rules? I already wrote that article for you. 🙂

4. Plan ahead for exceptions.

Planning ahead is crucial when it comes to having a successful no spend challenge. Before starting your challenge, take some time to plan out your meals, activities, and other expenses. Here are some specific questions to ask yourself:

- Are there any birthdays or other gift-giving holidays during this month?

- Are any family members coming to town I’m expected to host?

- Are there any specific events I’ve already committed to attending, even if they cost money? (If so, are there any ways to reduce the expenses associated with going?)

5. Clean your house.

I know, this one sounds weird. But you’ll likely be spending more time at home if you’re used to eating at restaurants or going out for entertainment a lot. You’ll have a harder time sticking to your no spend goals if your house mess stresses you out!

As a bonus, you can use a thorough house cleaning to take up the time you might otherwise spend shopping. And you’ll probably find useful things you forgot about, or items you can sell secondhand to further crush your savings goals.

6. Find free or low-cost activities.

One of the biggest challenges of a no spend challenge is finding ways to occupy your time without spending money. This is especially true for people who are used to doing all their socializing away from home. However, there are plenty of free or low-cost activities that you can do either alone or with friends, such as walking around a farmer’s market, doing puzzles from the library, or having a movie or board game night at home.

Be sure to check out local news sites, social media groups, your local library, and even the bulletin board at the grocery store to find free events happening in your area when you try your challenge. This will help you find ways to get out and be social without breaking your no spend streak.

7. Learn your spending triggers and avoid them.

Right now, certain events in your life tempt you to spend money. Using social media, passing favorite stores, having a bad day, and even spending time with certain people can be sources of temptation when you’re doing a no-spend challenge.

If you already know your triggers, planning ahead for how you’ll avoid them can help you avoid situations that might tempt you to spend money. And if you’re currently not sure, you can use your no spend month to learn your triggers to help you moving forward.

8. Track your progress.

It is SO important to track your progress during a no spend challenge. This can help you see how much money you’re saving, how your spending habits are changing, and what challenges you’re facing. You can use a spreadsheet, a journal, an app, or whatever else you like to track your progress.

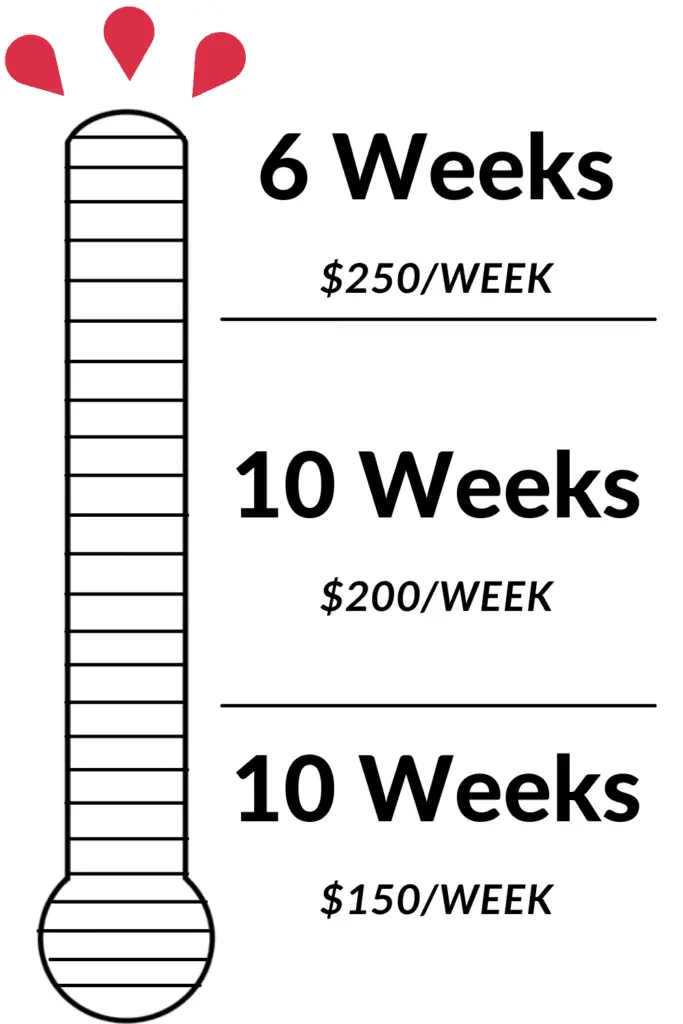

I personally like making little thermometers or other types of trackers that allow me to color in certain sections once I’ve met a goal or completed one more day without spending. Here’s one to help you if you’re specifically trying to save $5000 in 6 months:

9. Use what you have.

During a no spend challenge, it’s important to use what you have instead of buying new things. This means making meals with ingredients you already have, using up toiletries and household items before buying more, and finding creative ways to repurpose items you already own. I know during my challenge, I practiced this by using things I had around the house to make crafts with, instead of buying new craft supplies. By using what you have, you’ll both save money AND reduce waste.

10. Find accountability.

Doing a no spend month can be challenging, so it’s important to find support. In fact, when I interviewed dozens of former shopaholics, accountability was one of the most important steps for them to stop spending money. This could take multiple forms.

Your first option is to enlist someone like a friend or family member who is also doing a no spend challenge. This way you can have someone who’s experiencing the same struggles and temptations as you, and you can lift each other up.

The second option is to find someone who’s not doing a no spend month themselves, but they’re willing to keep you accountable. Maybe this means they don’t invite you out to eat, and instead offer to host an at-home potluck or other free form of socialization. At least they’ll cheer on your successes and give you pep talks if you slip up.

Either way, plan how often you’ll check in ahead of time.

11. Plan what you’ll eat.

For some people, learning how to stop eating out is one of the hardest parts of a no buy challenge.

One of the biggest triggers for people going out to eat is saying “we have nothing at home!” To combat this temptation, think about what meals you’ll eat BEFORE you hit the grocery store. You don’t need to plan everything down to the day, either. Even just saying “This week, I’ll make lasagna, taco salads, chicken stir fry, and BBQ” and choosing which day to cook later is fine. Don’t forget to expect leftovers!

But what if you don’t know how to cook? Well…

12. Learn new skills.

Your no spend challenge can be a great opportunity to learn new skills, such as cooking and baking. All you need to do is pull up some beginner “cook with me” YouTube videos and get to cracking those eggs!

There are plenty of skills you might learn that can actually save you more money in the long run too, such as budgeting, sewing, and gardening. Some skills might go a step further and actually MAKE you money, like getting a certificate, learning to freelance, or whatever might get you that next promotion at work.

By learning new skills, you can save money, have fun, AND use up some time that you might have otherwise spent shopping or spending money.

13. Swap items or barter.

I promise you. Things WILL come up during your no spend month that you didn’t expect and couldn’t have predicted. When this happens, you’ll have a choice: cave to the unexpected surprise, or get creative with alternative solutions.

This goes back to the heart of frugal living from back in our grandparent’s time. Haven’t you ever heard the story of when Grandma went to the neighbor’s to borrow a cup of sugar?

If you need something but don’t want to spend money on it, consider swapping items with friends. For example, you could swap clothes, books, or kitchen gadgets.

If you don’t know anyone who’s willing to part with the item you need for free, see if anyone would be willing to barter. Could you mow their lawn, give them a lift to the grocery store, or babysit for an hour? It’s always worth an ask!

14. Practice gratitude.

Practicing gratitude can help you appreciate what you have and reduce the desire to buy more. Take some time each day to reflect on what you’re grateful for and how your no spend challenge is helping you achieve your goals.

15. Celebrate your successes.

Finally, make sure to celebrate your successes, both during and at the end of your no spend challenge. This is especially important if you’re doing a challenge that’s longer than a week, because you’ll need the motivation that comes from seeing your progress.

Whether you’ve saved money, reduced your consumption, or broken a bad habit, take some time to acknowledge your achievements and reward yourself for your hard work. Just be sure you don’t binge at the end of the month and blow through all the money you saved!

There you go! I hope these tips were helpful, and you’re now fired up to tackle your own no spend month challenge. If you’d like more tips and tricks for living on a budget, be sure to subscribe to my email newsletter below!