According to Mint, 65% of Americans don’t know how much they spent last month. If you’re ready to stop being one of them, I’ve created a free printable expense tracker to help you out. (Actually, I’ve made several. You’re welcome!)

I know I tend to talk more about frugal living here, but you do need to spend money eventually. Using an expense tracker can help you know how much you’re spending. This can highlight areas of your lifestyle that might benefit from some trimming.

Though most people might think tracking and budgeting are the same thing, they’re actually not! Before you can make a plan and set a monthly budget, you need to know what your expenses are. Using expense trackers like this is the first step to setting a killer budget and, therefore, financial freedom.

You use different trackers depending on what kind of information you need. Here are some potential questions an expense tracker can answer:

- How much am I spending?

- When am I spending it?

- What categories am I spending the most in?

- Do I spend the most money with cash, credit cards, debit cards, or platforms like Payapl or Venmo?

- Which partner or spouse spent what?

- Am I spending more on regular or unexpected expenses?

In just a few seconds a day, you can track all your purchases, bills, and expenses. Then, at the end of the month, you’ll know EXACTLY where all your money went! Once you know that, you’ll be able to set a budget, save for big expenses, pay down debt, or meet whatever financial goals you have.

You might also like: How to Save $5000 in 6 Months Or Faster (With Progress Chart!)

So easy, a teenager can do it

When I taught high school economics, I generally assigned my students to keep track of their spending for a week using expense trackers like these. I asked them to note what they spent, what they spent it on, what category the purchase fell into, and the date.

From just these four pieces of information, you can learn so much about yourself, what you value, and (of course) where your money is going. Our financial life is made up of behavior patterns, but it’s too hard to see the patterns during everyday life. However, when we write down our spending, the patterns become obvious!

Do you have a secret spending problem when it comes to groceries? (I was definitely guilty of this, once upon a time. And then I learned how to save money on groceries.) Or is your money disappearing down a black hole known as Amazon? Maybe you’re so generous with friends and family, you haven’t noticed you’re going into debt to do it? There’s only one way to find out!

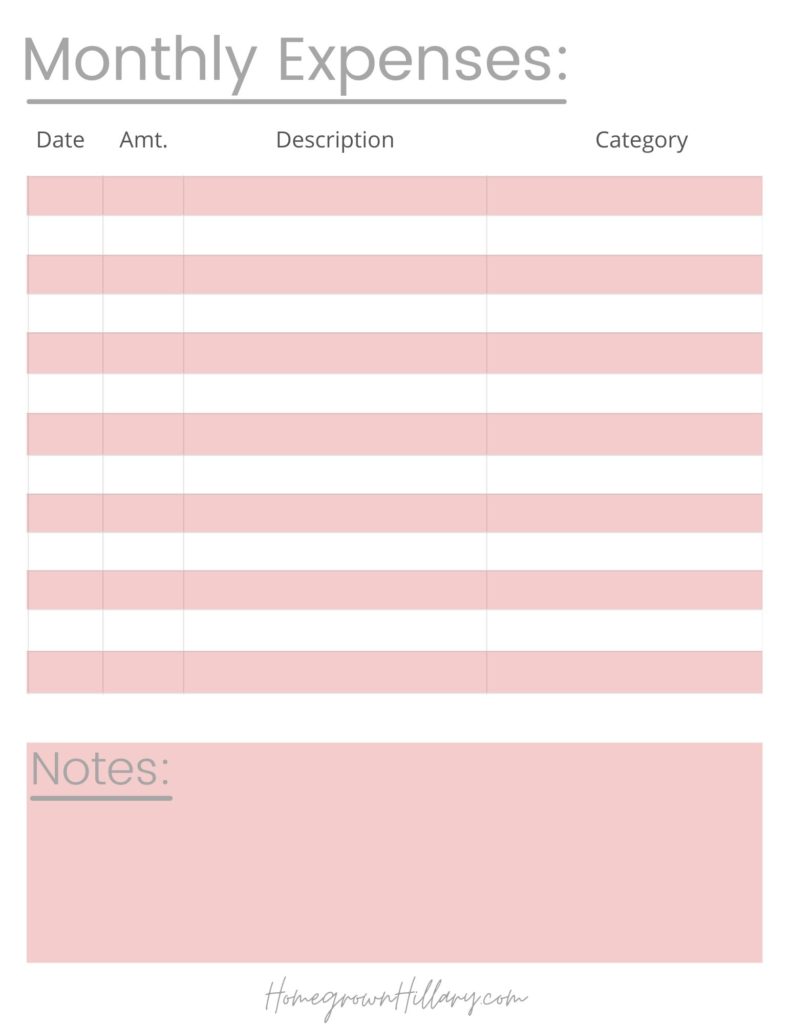

Basic Free Printable Expense Tracker

If you’re a complete beginner to expense tracking, try using this free printable expense tracker. It’s the most basic while still helping you track the most important data: the date, the amount you spent, what you spent it on, and what category it falls in.

Obviously, most people make more than 18 purchases a month. Just print out as many pages as you need to. (For reference, I’d need 4 pages in an average month to track all my family’s individual purchases and bills.)

But maybe you need something more than basic. Maybe you REALLY need to nail down your spending. The following spending trackers give you a bit more advanced information.

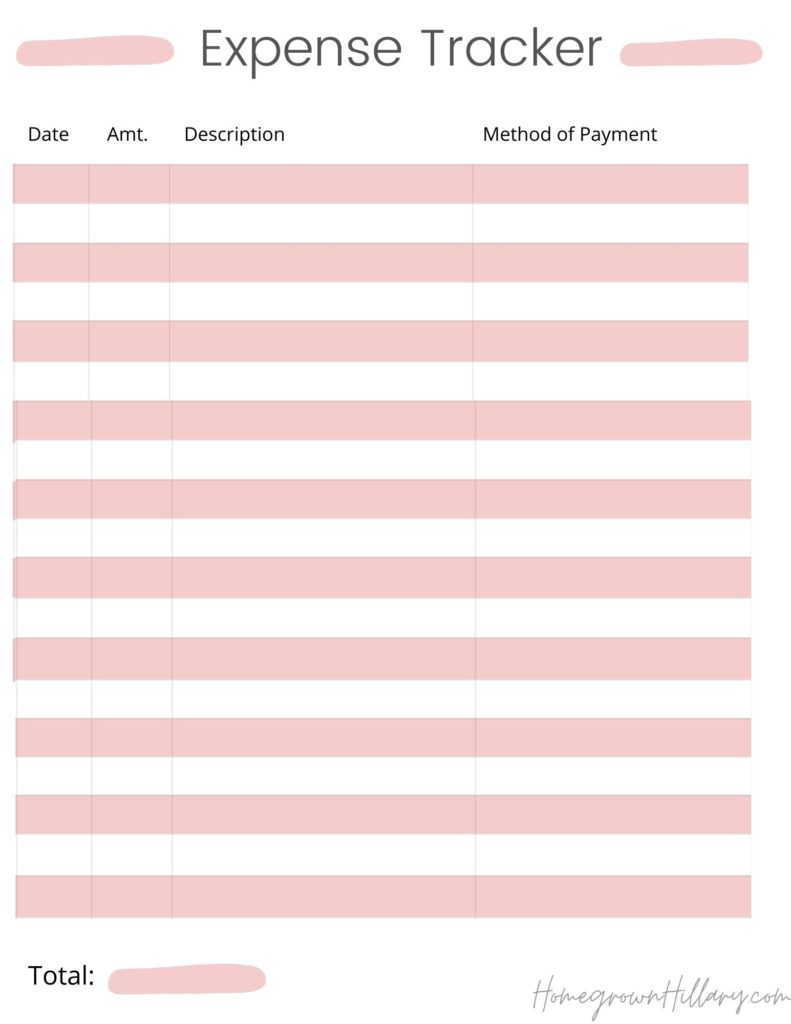

Method of Payment Tracker

Nowadays, there are so many different ways to spend money. Cash? Venmo? Check? CashApp? Credit Card? Paypal? It’s enough to make anyone think about quitting expense tracking altogether.

When you use a spending tracker like this one, you’ll be able to visualize all the different methods you’re using to spend money. Then, at the end of the month, you can tally them up to see how you’re spending everything.

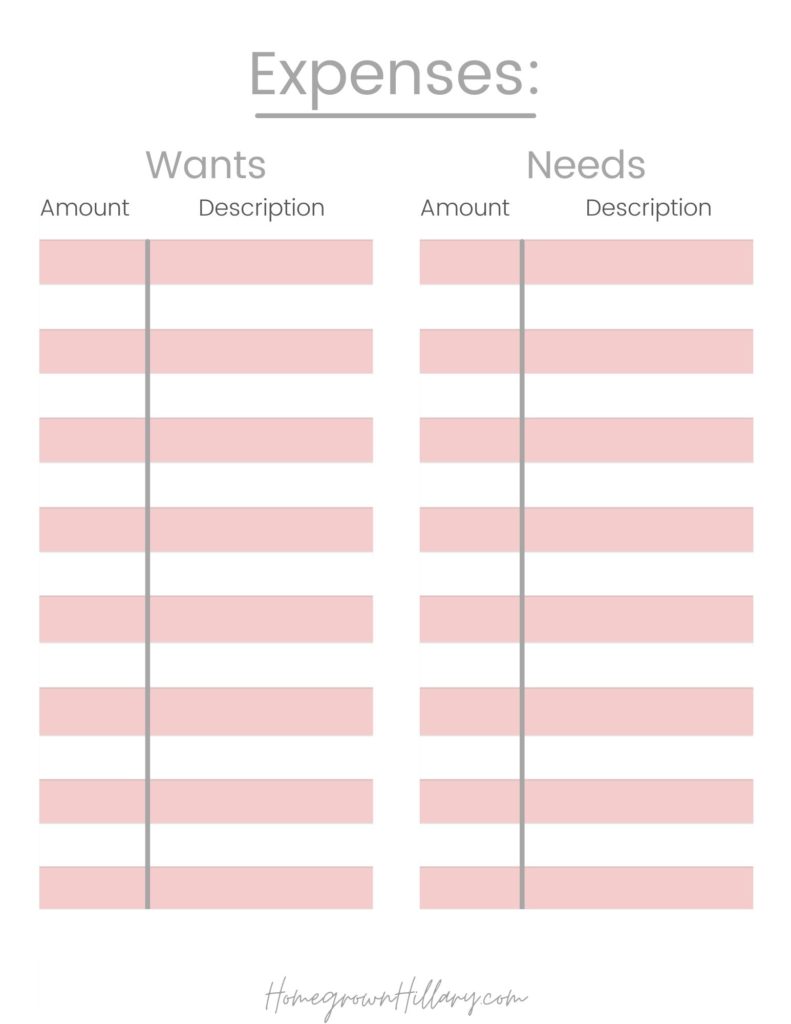

Wants vs. Needs Expense Tracker

The act of writing each expense into one of two categories will be a challenge, at first. That candy bar was food- does that make it groceries (and therefore essential)? Or is it an unnecessary impulse buy? If your old car broke down, is a brand new car really essential, or can you get away with a used one?

The lines might also change depending on your financial situation. A supplement or beauty treatment you considered essential last year, before a job loss, might feel more like a simple “quality of life” improvement now.

Only you can draw the lines for yourself and your family. But by writing down your wants and needs, you’ll start to learn what the difference is. Later, you can use that knowledge to help you curb spending and start hitting your financial goals.

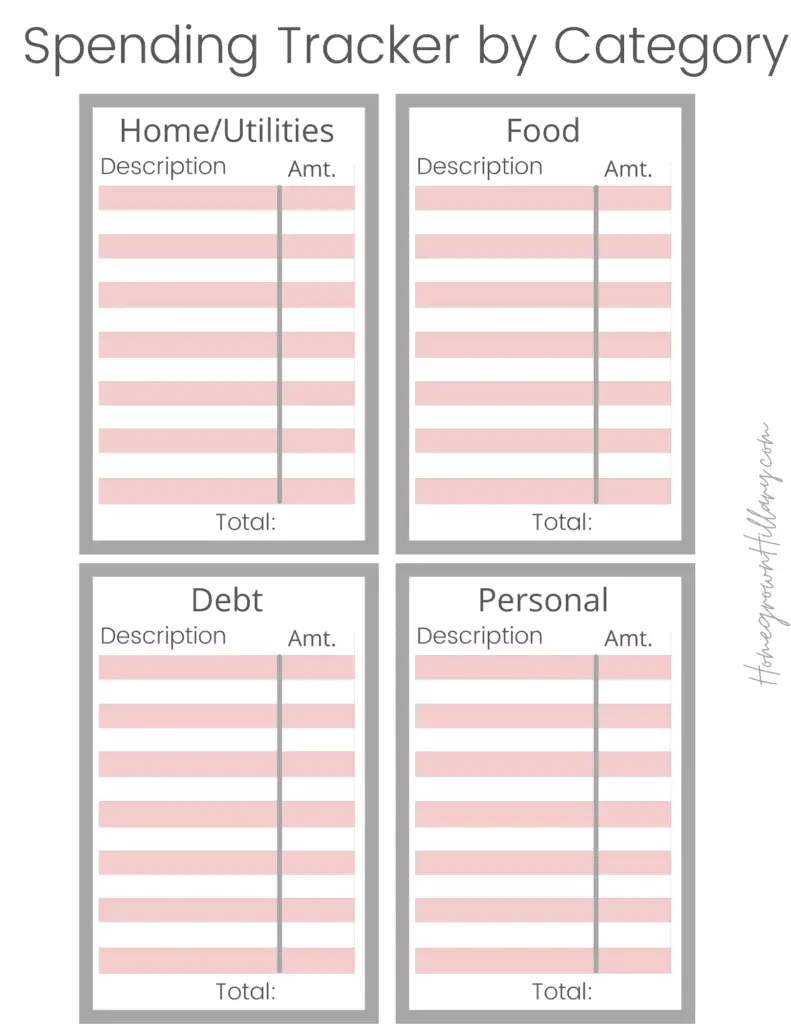

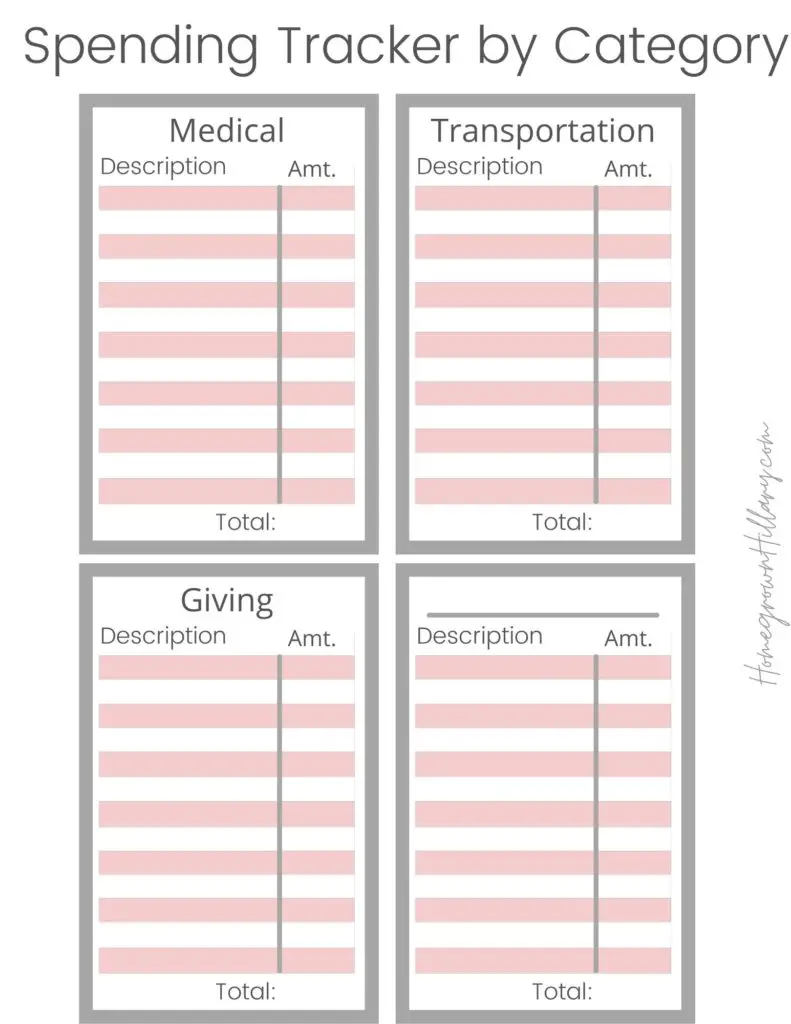

Printable Spending Log by Category

When you’re first learning to track your spending, one of the most important habits to master is tracking each purchase into one and only one category. This will be critical when you start budgeting and assigning limits to your spending in each category.

Common categories include home/utilities, transportation, food, debt, personal, medical, and giving. Whatever your personal categories are, make sure you focus on assigning each purchase to its rightful space.

Pro-tip: You can “split” receipts! For example, if you bought something like food and motor oil in the same trip to Walmart, you can “split” the receipt on your tracking sheets so $80 goes to your food category and $15 goes to automotive, or whatever.

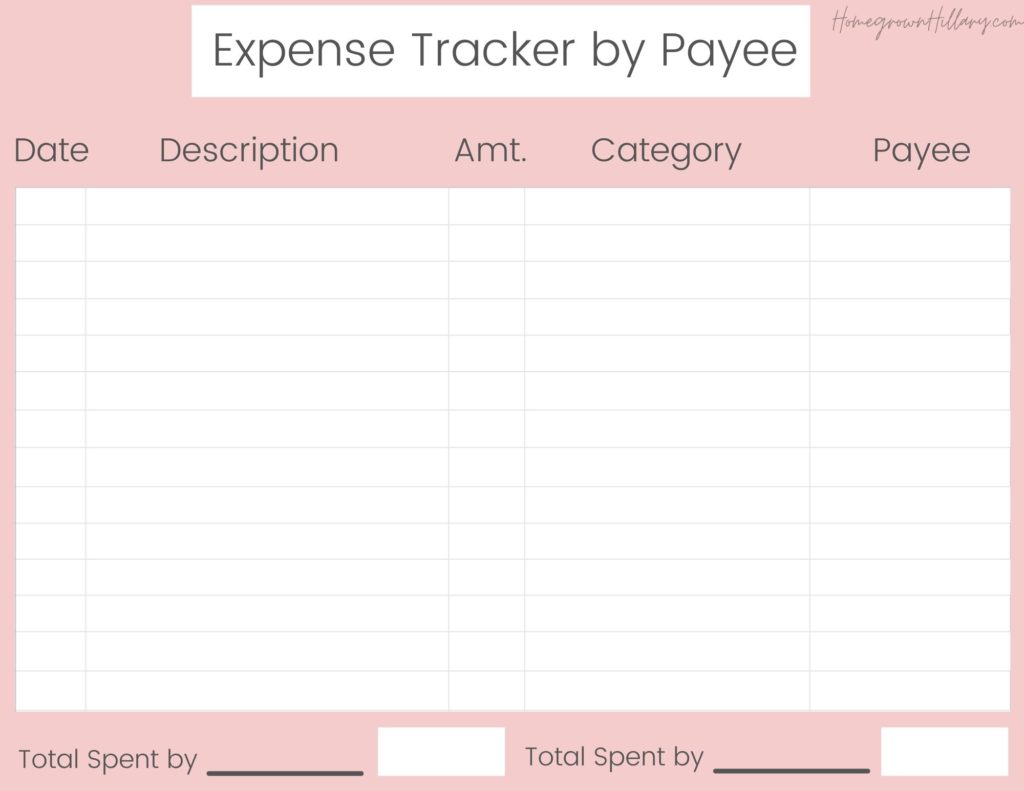

Who Spent What?

First, let me say that I will not be responsible for fights at your house! Sometimes, seeing exactly how much you and your spouse actually spend might be a wake-up call. Who knew you (or they) were spending so much money??

When preparing to track spending by spouse, I’d suggest not beginning with the intent to prove “I told you so.” Instead, focus on how much you both can move forward financially once you know exactly where the money goes each month.

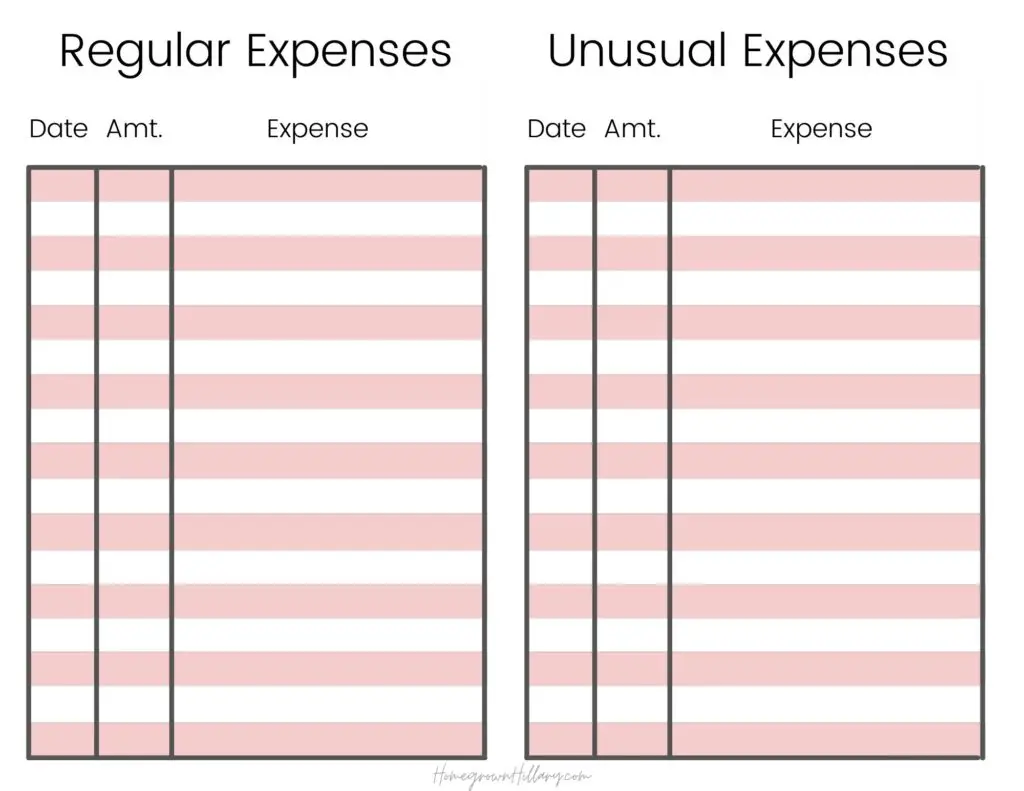

Regular vs. Unusual Expenses

This is my favorite tracking because no one ever thinks to label their expenses as “regular” or “unusual.” (You could also use ‘expected’ and ‘unexpected,’ ‘normal’ and ‘random,’ or whatever other two words help you keep track.)

If you go through life surprised by every bill and expense, you’ll never be able to save up an emergency fund. Because everything will feel like an emergency!

However, if you learn what expenses crop up every month, you can plan ahead for them. The first month you track, you may have way more things in the ‘unusual category.’ But by the second or third month, you’ll start to notice, “hey, I guess I always need three tanks of gas every month.” What felt like a horrible surprise becomes something you expect and have money set aside for.

Income Tracker

Finally, I know we’re focusing mostly on tracking expenses here, but it’s so important to track your family’s income as well.

Many families have regular, predictable income, either because they always work the same number of hours (without overtime), they’re salaried, or on fixed incomes.

However, many more families have irregular income. Stimulus checks, overtime hours, bonuses, unexpected gifts, self-employment income, money from a side gig, and more should all be tracked each month. Then, and only then, will you know how much you have to spend! (Because if you’re spending money you don’t have, that’s a road that leads to crushing debt and– if left unchecked– bankruptcy.)

Deluxe Free Printable Expense Tracker

Ok, so now we get down to the hard part. You’ve gone through and thought, “oh yeah, I should probably track that. And that. And oh wait, that would be good, too.” Now what?

I’ve created one more free printable expense tracker for you nerds out there (like me) who want to know all the things.

It’s got spaces to track everything I’ve already described, plus a space for notes. If you want to print it, you can! It fits exactly on one sheet of copy paper.

But if you want to use it as an Excel spreadsheet or Google Sheet, you can! It will automatically do the math for you and tell you exactly how much money you spend each month, too.

Subscribe to the form above to have the deluxe expense tracker delivered straight to your email inbox!

If you’re spending too much in certain categories, why not learn how to save?