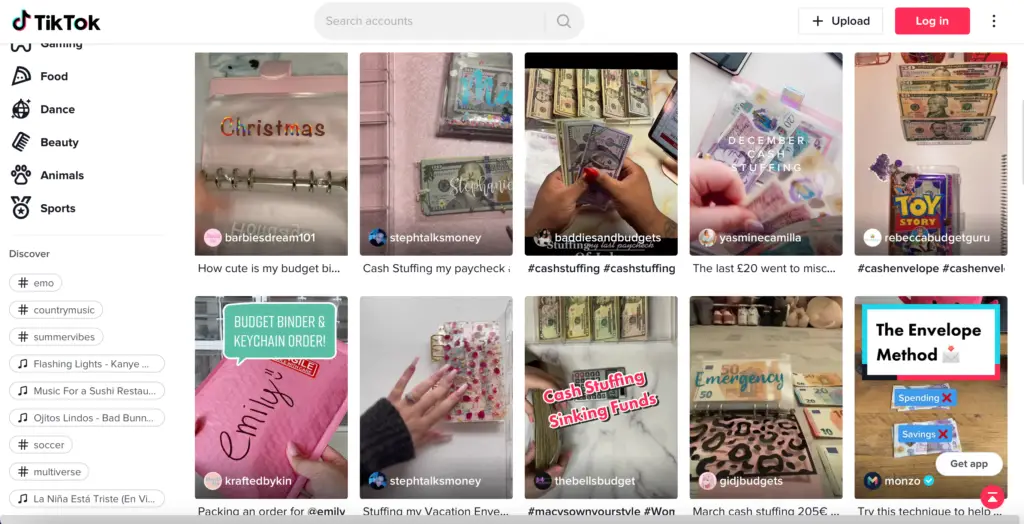

Have you heard of cash stuffing? The #CashStuffing trend is crushing it on social media sites like TikTok and Youtube, where content has been viewed hundreds of millions of times. Many of them feature pink pastel themes, a woman with awesome nails, gorgeous binders or envelopes, and HUGE stacks of cash.

For people who are new to budgeting, or maybe haven’t even started yet, the cash stuffing system is attractive and exciting. This is especially true for people who feel like they’re clueless when it comes to money, and find the hands-on nature more understandable. People who are barely scraping by and living paycheck to paycheck might also be intrigued by the promise of always having cash on hand and even being able to save.

But should you personally start a cash stuffing system, or stick with more digital methods of money management? Today, I’m walking you through everything you need to know to make a decision, plus sharing insights from experts along the way.

What is Cash Stuffing?

“Cash stuffing is a budgeting system where you use physical cash to budget monthly,” says financial advisor Erica Mathews. Basically, you “cash” out every paycheck and “stuff” it into envelopes that represent both spending and savings categories: groceries, rent, car payment, emergency fund, etc.

Obviously, the cash stuffing method means visiting the bank a lot. In addition to cashing paychecks or withdrawing direct deposit checks, stuffers need to make deposits in the amount of upcoming online bills and when they’ve reached a threshold of “too much cash on hand.”

What’s different about cash stuffing is often the “gamified” approach. Unlike the dry and sometimes overwhelming world of budgeting spreadsheets, cash stuffing has physical tokens, colorful trackers, and challenges with rewards to help you reach your goals. Especially for younger users and beginning budgeters, cash stuffing often provides more intrinsic motivation to keep working towards financial goals.

If this all-cash mentality sounds countercultural, it is. A Gallup poll shows more and more people are using electronic payment methods (like debit and credit cards, Apple Pay, PayPal, etc) with only 24% of people saying they make “all” or “most” of their purchases in cash. The digital trend is even more popular among those in the Millennial and Gen-Z crowd, who are even more comfortable with apps and touchless payment methods.

But though it’s countercultural, it’s definitely not the first budgeting system to look primarily to cash.

Cash Stuffing vs. The Envelope System

In general, cash stuffing often focuses on dealing exclusively with cash, only depositing money into a bank when absolutely necessary. The envelope system, as popularized by financial guru Dave Ramsey, has a more narrow focus and sticks to only using cash in categories where it’s easy to overspend with a credit or debt card.

Individuals who stick to the cash stuffing system (which, confusingly, is sometimes also called the cash envelope system) will have a detailed binder of envelopes to keep track of every category in their budget. The binder usually holds all the envelopes for different bills, the least-used spending categories, and all the savings categories like Christmas gifts, a wedding, or vacation. This big binder of cash stays at home. In addition, cash stuffers also usually have a large wallet containing sections for different popular spending categories like groceries, gas, entertainment, and personal use. This wallet goes out and about with them for easy access during shopping trips and commuting.

People who use the envelope system, however, don’t have that big binder of envelopes at home. They’ll keep all the money they need for paying bills, savings goals, and their emergency fund in their bank account, and do all the budgeting and planning of their money in an app, spreadsheet, or plain notebook. They will have a large wallet like cash stuffers do for going out and about, though. They’ll keep the wallet organized with dividers to keep that spending cash on hand for getting things like groceries, clothes, and gas.

At the end of the day, both systems think cash is king, and both can really help you get your financial house in order. So is it worth trying your hand at cash stuffing?

Pros to Cash Stuffing

Helps you stick to your budget

When you’re shopping with a credit card, you can easily choose to spend $50 on kid’s shoes, even if you only meant to spend $25. You’ll just charge it and make it next month’s problem. But if you go into the store with only $25 in cash, spending more is physically impossible.

Using cash stuffing methods can make you stick to your money goals by not giving you another option. Mathews agrees, saying that cash stuffing, “…is beneficial for people who have a hard time understanding how much money they are spending in different areas of their life. It is a great opportunity to hold yourself accountable.”

If you’ve been struggling with overspending, cash stuffing is likely going to help tremendously.

You’ll spend less money overall

Studies show that using cash is a more psychologically painful process than using electronic methods. Cards, apps, and touchless phone payments don’t always register in your brain as spending actual money. But when you use cash, you have to hand it over to a cashier and don’t get it back. Your brain registers this as a kind of loss, so you’ll seek to minimize that pain when paying in cash at the store. Therefore, you spend less money when paying with cash compared to when you pay with a card or digital method.

Makes budgeting concrete and tangible

Sometimes, trying to budget on paper or spreadsheets can feel like you’re just writing meaningless numbers. Cold, hard cash, on the other hand, never has this problem. If you have to count out all the cash for your bills and expenses by hand, you can see exactly where your money needs to go every month, and how much you might have left over if you stuck to that budget.

Reduces financial stress

Bills and expenses take up valuable real estate in our brains. Worrying about whether or not you’ll have enough money to cover the essentials is a serious problem for many people, but cash stuffing can help somewhat. Of course, using cash doesn’t magically earn you more money. But being able to see enough money in the “rent” envelope ahead of time means you don’t have to think or worry about whether you’ll have enough.

A person who sees $300 in their bank account might not remember if the electric bill already came out, or if they still need to pay their mom back $50, or if they can use that money for something fun. But if you have everything organized into envelopes, you can feel good about spending any cash left over, worry-free.

Increases motivation

If you’ve tried budgeting before but got bored, distracted, or overwhelmed, cash stuffing will likely be different. Just like when you had math class as a kid and counting with marbles or blocks was more fun than doing worksheets, doing your budget is just more fun with physical money.

In addition, lots of cash stuffers get into savings challenges and special sinking funds. Who doesn’t want to set a goal and watch their envelope get fatter over time? Some go one step further though and use envelope inserts. They get to color in a design or square on a grid every time they make a ‘deposit’ into the envelope. When they’re done the challenge, they’ll have a fat stack of cash and a fully colored insert showing how long they’d worked toward the goal.

Cons to Cash Stuffing

No liability protection

“Most credit and debt cards have some sort of liability protection,” says Mathews. This means that if you lose your card or it’s stolen, the bank or credit card company won’t hold you liable for any charges someone racks up on it. If you lose a card, all your money is still safe, and you can be issued a new one.

If you lose your money, however, it’s gone. Permanently. “For that reason, I would steer people more toward an electronic tracking and budgeting system than a cash envelope system,” says Mathews.

Loss of Interest

Hundreds of dollars sitting in envelopes in your house aren’t earning any interest, unlike money sitting in a bank account. With inflation at an all-time high, that means every dollar you keep at home is not earning interest, and actually losing value.

If, however, you kept your money in a savings account, especially what’s called a “high yield savings account,” you’d be making money by doing nothing. Currently, rates are *great* if you’re willing to open a new account, with some banks offering 4% interest on the money you leave with them.

If you’d prefer to use something other than a traditional bank, PayPal’s offering 3.75% to stash your cash with them (plus, they’ll give you $5 when you open a new account).

Less convenient

This is baked into the strategy itself (it works in part because it’s inconvenient), but it’s still worth mentioning. Needing to go to the bank and make a deposit every time you have an online bill to pay isn’t fun. Neither is needing a physical bank to cash out from when you get your paycheck. And if you get to the grocery store and REALLY need all five items in your cart, but only have enough to pay for four, that can get old really fast.

It doesn’t magically create discipline

You still need willpower to not to spend money even if you’re using a cash stuffing budget method. Otherwise, you’ll just see cash lying around and head to the mall. Of course, you’ll have to notice you’re taking a $20 from the envelope marked “student loan payment,” which should help strengthen your resolve. But if you don’t have that discipline yet, having too much cash on hand might exacerbate your spending problems.

Physical security concerns

Obviously, carrying around thousands of dollars in cash can be a problem, depending on your neighborhood. If word gets out that you use a cash stuffing budgeting system, you might be a target for theft (either at home or out and about). Banks, on the other hand, are FDIC insured, so you don’t have to worry about your cash when it’s there.

So… Should You Start Cash Stuffing?

“I would say go for it,” says Mathews. “Try it for a month or two and see if it works for you! It’s not best for everyone, but it can be a wonderful tool for getting your finances on track.” As long as you don’t lose your money or it’s stolen (and how likely is that?), the worst that can happen is you learn another budgeting style that doesn’t work for you.

The best case scenario is that you learn where your money has been going, you’re able to save some money towards your goals, and you’re comfortably able to pay your bills.

When my husband and I were getting our financial house in order after we got married (which I’ve talked about in my article on how to afford being a stay at home mom), we tried the cash envelope system for a month or two. It was so helpful for understanding exactly how much we were spending on things like groceries, which we previously had no idea how to budget for. Though we eventually switched to doing all our budgeting digitally, using cash for a while gave us a feeling of success with our money, which snowballed our motivation to become debt free.

What You Need to Set Up

If you’re ready to start cash stuffing, you don’t need much.

For those on a bare-bones budget, the only two things you’ll need are 1) cash and 2) a place to stuff it. That place could be a bunch of labelled ziplock bags, homemade and decorated envelopes made from copy paper, or a bunch of plastic school folders. (If you’re in this boat, you might make your first savings challenge “money for better envelope system.” There’s nothing wrong with going the DIY route, but some people feel more motivated to use the system when they enjoy the envelopes.)

Of course, many popular cash stuffers on social media will try to sell you fancy binders, envelope systems, and wallets. Rachel Cruz from Ramsey Solutions sells her line of leather cash envelope wallets for nearly $70! But you really don’t need anything fancy to start. Walmart sells a pack of 24 colorful cash envelopes for about $10, and you can choose from dozens of wallets with zippered envelope pouches on Amazon for under $15.

Some really dedicated cash stuffers also get cash sorting trays, similar to those you’d use when working at a cash register. I’ve also seen custom-designed savings challenges printables, cloth zippered pouches, and basically anything else you can think of.

How to Start Cash Stuffing

First, you’ll need to know how to divide up your bills by the number of paychecks you’re getting this month. Do you get paid weekly? Bi-weekly? Twice a month?

Once you know that, you’ll need to write out a written budget that covers four categories (scroll down for examples of each):

- your consistent, expected bills (like rent, car payments, etc)

- variable expenses (things like groceries or gas which change from month to month)

- sinking funds (mini-savings goals which you’re regularly pulling from to pay irregular expenses)

- savings challenges (for things like your emergency fund, large future expenses like a wedding or move, etc)

If you’re not sure how much your expenses are generally, you should spend a month preparing to budget by keeping an expense tracker. I’ve got a few free, printable expense trackers available, or you can just use a notebook to keep track of everything you buy and spend money on for a month.

Once you know how much your expenses are, you’ll need to divide the total amount for each bill or expense in each category divided by the number of paychecks you get. Does your landlord charge $1,000 and you get paid twice a month? Looks like you’ll be putting $500 of each paycheck into the “rent” envelope. If your phone bill is $120 and you get paid four times this month, you’ll throw $30 into the “phone” envelope each and every paycheck. (This assumes you aren’t currently just paying each bill as it comes due with the money from your most recent paycheck. Jordan over at Jordan Budgets covers alternatives– including waiting to pay bills using the cash stuffing system– in more detail in the video below.)

Cash Envelope Categories List

You should have an envelope for every bill, expense, or savings goal you have when you’re using a cash stuffing budget. Some of the regular, predictable bills you likely have are:

- Rent/mortgage.

- Car payment.

- Electricity.

- Water/Sewer.

- Home or renters insurance.

- Car insurance.

- Health insurance.

- Cell phone.

- Cable/Streaming services.

- Internet.

- Student loan payments.

- Credit card payments.

- Other debts.

Of course, there are plenty of other expenses you have in a month. Here are a few common examples of variable expenses you need to have envelopes for if you’re cash stuffing:

- Groceries.

- Eating out.

- Clothes.

- Gas.

- Kid’s spending money.

- Medical.

- Beauty and personal care.

- Entertainment.

- Miscellaneous.

Finally, cash stuffing is great at helping you set and meet savings challenges and having sinking funds. I’ve written a deep dive on sinking funds with some expert financial planners giving their advice if you’d like to learn more. But if you just want ideas, here are some examples of both to get you thinking about your own financial goals and expenses:

- Car maintenance

- Charitable giving

- Christmas/gift giving

- Irregular energy expenses (heating oil, propane, etc)

- Home improvement projects

- Vacation fund

- New car fund

- Moving expenses fund

- Home down payment

- New baby fund

- Wedding fund

There you have it! All you need to know about the cash stuffing budgeting system. If you’d like more money hacks, subscribe to my newsletter below for weekly updates.