When it comes to avoiding debt and preparing for big expenses, having different sinking fund categories is crucial. Imagine this scenario:

You’ve just paid off all your bills this paycheck, then get a surprise. Maybe it’s time to renew your Amazon subscription, or you need car maintenance, or you forgot it’s your mom’s birthday. How do you pay for it?

- Use your emergency fund

- Use a credit card and worry about paying it next month (or next month + a few months after that)

- Pull from a specific sinking fund and get on with your life

Obviously, option C makes the most sense. Things like holidays, irregular bills, and maintenance are EXPECTED expenses, so they don’t count as an emergency. It’s also better to avoid paying interest on bills when you can plan ahead instead.

But when should you start a sinking fund? Can you have too many sinking funds? And which sinking fund categories are the most important?

Today, I sat down with some financial advisors and CPAs to get all your sinking fund questions answered.

What is a Sinking Fund?

Sinking funds are targeted savings accounts which help you save money for expected expenses in the future. Sometimes those expenses are large, like a home down payment. Other times they’re smaller, like the fund that pays your quarterly water bill.

Saving money in general is good, but sinking funds are more specific than general savings. They’re not a savings account, which doesn’t focus on a goal other than accruing interest.

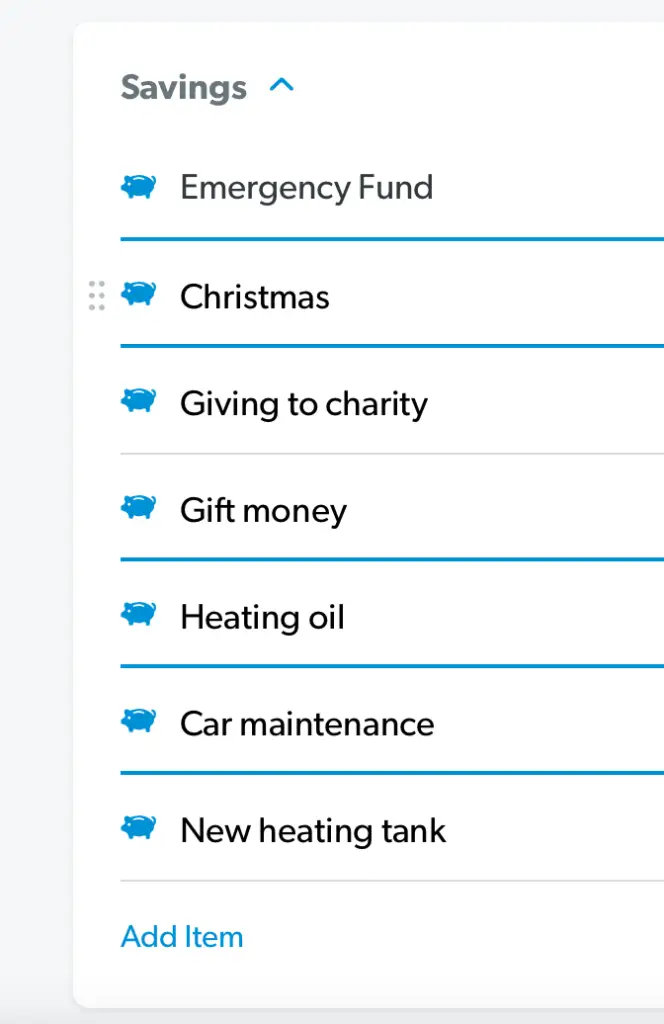

You may have just one sinking fund at a time, but it’s often more helpful to have multiple sinking funds, each for a different purpose.

Of course, you can’t have unlimited sinking funds. Eventually, you’ll need to make hard decisions. “You should probably prioritize saving for your insurance premiums over Christmas,” says Claire Hunsaker, ChFC® and founder of AskFlossie, a financial community for women. “Sometimes the tradeoffs are hard, but that’s ok. Good budgeting forces conversations about where you value spending your money.”

Emergency Funds vs Sinking Funds

Hunsaker also says many people confuse emergency funds and sinking funds: “Emergency funds are for emergencies. Sinking funds are for predictable costs that don’t happen regularly. [With sinking funds], you know how much money you need to save and what you’ll use it for, but maybe not when.”

Another difference is in size. The average emergency fund will be larger than most sinking funds. Most experts recommend having 3-6 months worth of expenses stashed away in an emergency fund. (If you don’t know how much that would be for you personally, you can use my free printable expense trackers to figure it out.) A large emergency fund gives you enough of a financial cushion to help with big emergencies, like getting laid off.

Sinking funds, on the other hand, only need to have enough to cover the predicted costs. If your quarterly water bill is $150, you never need more than that in the fund at one time.

When to Start a New Sinking Fund

If you’re not sure whether a future expense deserves its own sinking fund, here’s a good rule of thumb. According to Brennan Schlagbaum, a CPA and the owner and founder of BudgetDog, you should plan on creating a sinking fund “for any future expense over one month of discretionary income.”

So if you always have $300 left over each month after all your bills are paid, that’s your discretionary income. That means any upcoming expense MORE than $300 needs its own sinking fund.

Most Common Sinking Fund Categories

It’s simple enough to break sinking funds into two types: large, one-time sinking funds and revolving sinking funds. Here are some examples of each, according to the experts.

Large, One-Time Sinking Fund Categories

These are funds you build up over time because you’ll soon need a lot of cash to cover the bill. After the event, you’ll close the sinking fund and never use it again (or at least not for a while).

- Home down payment

- New car

- Upcoming life events (wedding, new baby, moving expenses, etc)

- Specific travel plans

“The majority of my clients use sinking funds for the three big items: Home down payment, car, and vacations,” says Schlagbaum.

These ones are fairly obvious in their purpose. If you don’t save up ahead of time for a down payment, you either don’t get the house, or you get the mortgage at a much higher interest rate. The same often goes for cars.

With expensive life events or one-time travel plans, your alternative to a sinking fund is usually paying with a credit card. If you charge the expense, you’ll still be making payments over time, except with interest. Creating a sinking fund also allows you to “make payments” over time (i.e. stashing them in your savings account) but it saves you from paying the interest.

Revolving Sinking Fund Categories

These are sinking funds you create because you’ll need to dip into them occasionally, but regularly. Unlike your big, one-time sinking funds, these are more like revolving doors, because you’ll be putting money in every month, and taking some out at least once a year.

It’s pretty easy to find good candidates for sinking funds by going back and looking over your monthly budgets from the last year. However, if you’re worried about forgetting something, I’ve compiled a few examples suggested by our financial advisor friends.

5. Holidays / Christmas

All of the experts I spoke with mentioned holiday expenses. You know they come up every year, so having a sinking fund saves your finances in two ways. First, it prevents you from charging Christmas on the Mastercard by giving you 12 months to save up. But in addition, it also gives you a very specific budget to keep you and your overall money goals on track.

6. Other Gifts

Graduations, weddings, birthdays, and other festivities often require presents and sometimes decorations. Having a sinking fund for all-purpose merriment means you can pull from it when you accidentally forget about your mom’s birthday until the night before.

7. Taxes

Self-employed people especially need to have a sinking fund for taxes. This includes people with a side hustle! According to the IRS, you’ll need to make regular estimated tax payments if you “expect to owe tax of $1,000 or more when your return is filed.” Have your tax preparer estimate what you should put aside in a ‘taxes sinking fund’ each month if you need help.

8. Irregular Utilities

In my house, every utility except electricity and cell phones is paid on a quarterly or seasonal schedule. Water, sewer, trash, HOA fees, gas, propane, or heating oil might be other utilities you create sinking funds for in your personal budget.

9. Car maintenance

Even if you bought a brand new car, car maintenance is a common and important sinking fund category. “Cars need to be maintained,” says Hunsaker. “That maintenance is perfect for a sinking fund – it’s intermittent and big, but it’s actually predictable.”

Oil changes, tire rotations, and other preventative maintenance should come up every few months. If you have an older car, or one that’s prone to breaking down, you may want to have a larger car maintenance sinking fund. For those cars, you’ll need to cover the cost of failing parts and replacement systems in addition to regular maintenance.

10. Dues, fees, & subscriptions

Some people prefer thinking about their Amazon Prime fees in terms of $11.50/month instead of $139/year. Even though you’re only charged on the anniversary of signing up, you can create sinking funds for yearly expenses like these.

Other examples of yearly expenses might be membership fees for things like AAA or Costco, dues for clubs, unions, or housing associations, and online subscriptions.

11. Clothing

Most people do not buy clothes every month, even with kids. (Unless you struggle to stop buying stuff, in which case you might buy more often.) Buying new clothes seasonally and as kids grow out of their old sizes is more common. Having a sinking fund allows you to keep up with the irregular timing of clothes shopping.

12. Home maintenance

If you own a home, you absolutely need a fund of some kind for upcoming projects. Some people put in a set amount every month regardless of what’s happening, others only start saving when there’s a known expense coming up (and will cover any emergencies with their emergency fund). Either method works!

13. Insurance premiums & deductibles

Every insurance company does things differently, but many companies who provide renters, home, auto, or life insurance don’t bill you monthly. Having a sinking fund for the premiums or the total amount of the deductible (or both!) saves you from needing to come up with the cash all at once.

14. Medical expenses

You know you’re going to have small medical needs come up regularly: a bottle of ibuprofen here, an office visit deductible there, etc. You shouldn’t be surprised when you’re not perfectly healthy all the time!

If you qualify, a Health Savings Account (or HSA) is a great place to keep your health-related sinking funds since they’re tax advantaged.

15. “Fun” money

Here’s my favorite category! Everyone in our family has their own “fun” sinking fund. It’s where we put all gift money throughout the year, and each individual can draw from it whenever they choose. We also regularly put aside a set amount into the ‘fun money’ sinking fund to pay for spontaneous trips, outings, and personal purchases.

16. Charity

While many people budget to regularly give gifts to their favorite organizations, churches, or non-profits, sometimes it’s nice to be able to help whenever a need arises. Charitable giving sinking funds allow you to make donations when there’s a natural disaster, war, or other calamity. They can also help when your neighbor gets sick or you want to buy a cup of coffee for the person behind you. Sinking funds for good deed allow you to be generous and still stick to your budget!

17. Pet expenses

Pet insurance is great, but it doesn’t cover everything. Chances are, you’ll need to spend money to pay for vet visits, grooming, beds/habitats, and other supplies– but not every month. Figure out how much you’ve spent over the past year and divide that number by 12 to calculate how much to monthly stash away in a pet sinking fund.

18. Seasonal kid costs

Irregular costs for family life are common. Think about things like “sports, activities, and childcare during school breaks,” advises Hunsaker. You might also include things like field trips, back-to-school shopping, and private lessons or tutoring in a kid’s sinking fund.

There you have it! 18 sinking fund categories, courtesy of some friendly financial experts. Did I miss any of the funds you use in your budget? Let me know in comments!

And if you’d like to get more money-saving tips straight to your email inbox every Saturday, be sure to subscribe to my newsletter below.