If you’ve been wondering how to save 5000 in 6 months, it might be easier than you think. Many people think they’ll have to eat Ramen noodles, sleep in a cardboard box, or hunt for pennies in the couch. Thankfully, practicing frugal living doesn’t mean life has to suck!

Any time you try to meet a big goal like saving $5,000 in just a few months, it will require a change in behavior, priorities, or both. Anyone who says differently is selling something. The good news is, you get to choose which behaviors to change and which to keep. If you want to save money REALLY fast, you can live that ramen life (or, even better, just learn How to Save Money on Groceries Without Coupons and/or learn to cook some dirt cheap meals). Otherwise, you can read through the following options and pick which ones make the most sense for your life.

Truthfully, EVERYONE should do #1, #2, and #7, but the rest are all optional. It will just depend on how fast you need to save money and what your current spending habits look like.

You might also like: Free Printable Expense Tracker: The Best Ways to Track Your Money

How to Save 5000 in 6 Months

Answer Your “Why”

Are you trying to save $5000 in 6 months so you can have a house down payment? Do you want to get married? Do you have a baby coming and are freaking out? Or maybe you just need a good emergency fund in case of “rainy days.” Everyone has their reason, and you need to really focus on yours.

Because staying motivated is critical to reaching your goals, print out some pictures that will help keep up that motivation. Heck, fill a whole cork board if you want. Use pictures like a beautiful dream house, your fiance, a pair of baby shoes, whatever. You need to keep getting those warm, fuzzy feelings which will strengthen your desire to keep going. Make sure you put these pictures in a place you’ll have to pass by and look at every day. The bathroom mirror, wherever you keep your keys, or the wallpaper on your phone are all good spots.

Estimated savings: Priceless

Get on a budget

Unlike what many people think, having a budget doesn’t mean you can’t have any fun. You can use online financial calculators to help you set a zero-based budgeting plan, which means you can still spend whatever you want- you just need to plan for it. Before the month starts, you write down (roughly) what you’ll make in the next month, and assign each dollar a job before you’ve spent it. Those $300 go to car expenses, that $1000 chunk is for rent, this $150 is for insurance, etc.

Check back soon for my explainer post on how to write a budget (even if you’re on a low income!)

Estimated savings: Varies

If you’re the kind of person who never knows whether the money is coming or going, you’re going to see SERIOUS savings when you start planning your spending. Simply writing everything down means you have to acknowledge when and where you spend money. That might be all the push you need to start saving.

Print out a progress thermometer chart

You’ve seen these before. They’re usually on the walls of schools, non-profits, or grocery stores to show how close the organization is to a fundraising goal.

The average person, when trying to start a new habit, quits before a full month of trying. That one month is the hardest period to crack. If you can keep your motivation up during that time, you’re much more likely to reach your full goal! Otherwise, it’s like leaving 80% of the potential savings on the table.

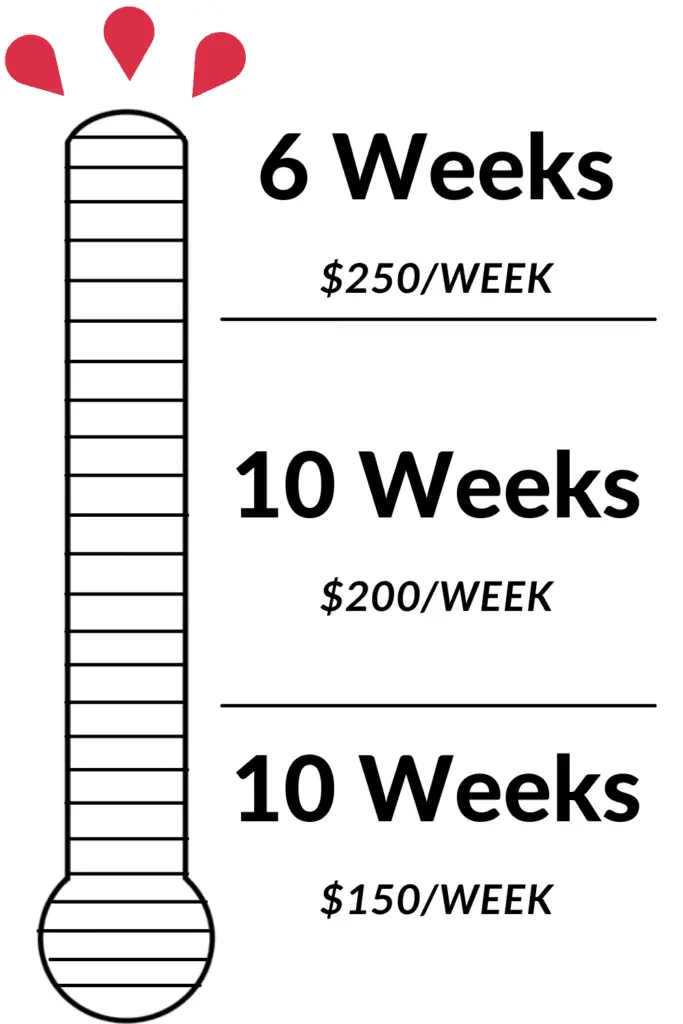

Still wondering how to save 5000 in 6 months? You’d need to color in $150 for 10 weeks, then $200 for another 10 weeks, and finally $250 for the last six weeks. Here’s a progress chart you can print out to help you keep track:

See if You Can Get Free Money

I mean, you can always ask with Uncle Bob if he wants to pay you that $10 back. But for this, I mean check with the government and deceptive companies.

Usa.gov can show you if you’re owed money from old tax returns, unclaimed property, bank closures, the VA, and certain kinds of mortgage insurance. $70 billion dollars are sitting around, unclaimed right now. I’d recommend checking periodically with your name, maiden name (if applicable) and family members names in any state you’ve had a mailing address in.

The other thing to check is class action lawsuits. Food companies, home goods manufacturers, and medical providers all routinely get sued collectively by dissatisfied buyers or clients, and if they win, you can benefit! If you frequently check Classaction.org/settlements, you can search for any settlements you may be entitled to. Many of these lawsuits don’t need proof of purchase either, though you can get more money if you have your receipts (but don’t be unethical and just apply for everything, now). Some examples I’ve seen recently are for Children’s Tylenol, Kellogg’s, Six Flags, Guinness, Windex, DoorDash, and Blue Cross/Blue Shield.

Plan Fun, Free things

There’s plenty of fun to be had for the great, low price of zero dollars. One of the biggest skills you’ll learn in this six months is how to get creative and think outside the cultural box. At-home game nights, movie marathons, and picnics are things you can do no matter where you live. Here are some more ideas for specific locations.

If you live in the city, this might be walking around a farmer’s market, finding a “free Friday” museum or class, or playing pickup soccer in the nearest park. You can also do geocaching.

If you live in the suburbs, get to your local library and rent some movies or video games. You can probably also find some college or high school sports teams to watch, or theatrical/musical performances to attend. Keep an eye on the town or city’s local facebook page to be the first to know about new, free opportunities.

Finally, if you live more rurally, you can go for a hike or walk through some natural spaces. You can also gather some friends and host a big bonfire (if you live somewhere that isn’t prone to wildfires). Biking and bird watching are also good options when you don’t live near a big metro area.

Estimated savings: $520

Assuming you spent money on only one fun thing a week, and it cost around $20, you’d save a little over five hundred dollars in six months. If you went out more often or spent more money, you’d have even more saved!

Learn how to hack the grocery store

I’ve written about how to save on groceries without coupons before in detail. The biggest hack is to always go with a list, but there’s so much more to learn. Ask people in your town or neighborhood about where they find all the best deals, and be willing to switch stores. And here’s a big tip- strike up conversations with the employees and see what they say about the quirks and see what insider knowledge they offer about their store.

Estimated savings: $1,200-$2,300

I easily shaved HALF off my grocery bills once I learned the right way to shop. So, let’s assume you’re an average American family of four and using what the USDA food plan calls a “low cost” grocery budget. A family in this category spends, on average, $766/month. By cutting half of that cost, you’d save $383/month, or $2,298 in total. Even if you feel there’s no WAY you could cut that much, even learning a few new tricks could save you $200 a month, or $1,200 in total.

Cut Unnecessary Costs

If you’re just doing this plan for six months, you can hold off on buying the unnecessary things for now, and add them back into your budget later. Or, you might find that after six months, you don’t miss some of these things anymore, and you can live quite happily without them indefinitely. That means money in your pocket every month!

Some unnecessary expenses might be…

- Chain-bought coffee (Gas station, McDonald’s, Starbucks, etc)

- Subscription services

- Gas station snacks

- In-app purchases

- Luxury clothes, handbags, skincare, or makeup

- Anything you bought just because you were bored

Estimated Savings: $700+

Let’s say our hypothetical person typically spent $2/day on coffee drinks, $9.99/month on streaming services, $5/week on a snack at the gas station, and $2.99 a couple times a month on random in-app purchases. All told, if they stopped spending in all of those categories, they’d save a hundred dollars a month!

Then, let’s add in even a single unnecessary pair of designer jeans at an (on sale price of) $100. Now we’ve saved $700 just from unnecessary spending!

Turn off targeted ads

Let me tell you. It is a LOT harder to ignore ads for products you actually might buy. When sites like youtube, facebook, or google follow you around online, they gather information about what you like, what you’ve bought, and when. Then, they show you ads based on the data profile they’ve collected, and it takes SO MUCH MORE willpower to avoid those purchases.

Since I’ve turned off targeted ads, I mostly see ads for scammy weight loss supplements, a year’s supply of survivalist foods, or a telescope. I have no problem saying no to any of those purchases (and I’m guessing you wouldn’t either).

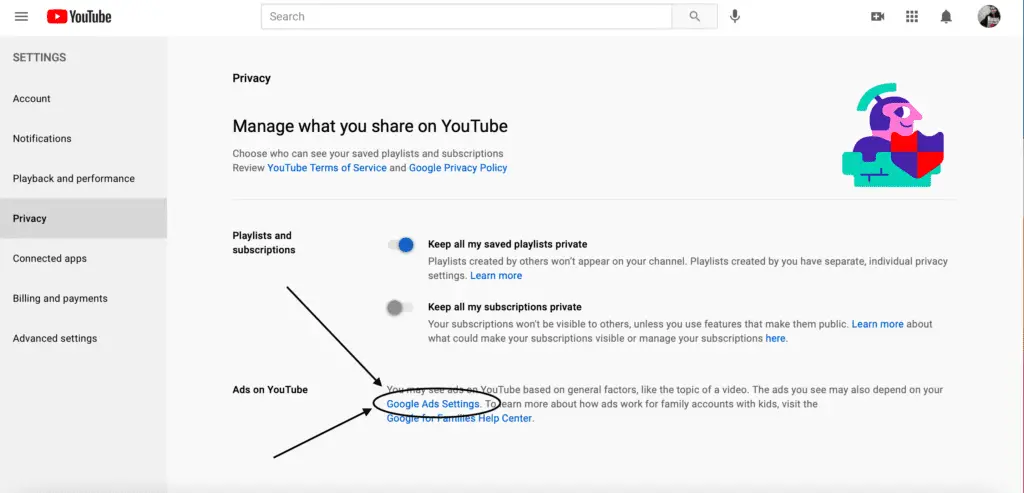

To turn off Youtube targeted ads, go to settings > privacy > Google Ad settings.

You can also start using a browser like DuckDuckGo that doesn’t track your viewing habits or show ads based on your browsing history.

Estimated savings: At least $300

Let’s imagine you would, on average, spend even $50 a month because of an ad (or ads) you saw online. If you turn off targeted ads and never buy those things, you’ll save three hundred smackeroos.

Stop (Or Reduce) Online Shopping

If two day Amazon shipping is your kryptonite, you need to kill it with fire. As I mention in my survey of how 50 former shopaholics learned to stop buying online, you need to remove temptation! Delete your card information from all your favorite retailers, unsubscribe from all their promotional emails, and type STOP when they send yet another sale text. And if you have a subscription to a site like Amazon or Walmart+, you get to count the savings from cancelling that subscription towards your goal!

Estimated savings: $78-$650 (but likely more)

If you do nothing but cancel your $12.99/month Amazon subscription, you save $78 over the course of six months.

However, this report shows the average Prime member spent, on average, $1,300 a year on the platform. And this data was compiled before the pandemic, meaning the modern averages are likely much, much higher.

Hide Your Money Somewhere You Can’t Get It

If you struggle with overspending, you’ll want to keep this new savings stash hidden! There are so many places you could temporarily keep this money, but I’d personally opt for opening a brand new bank account that’s unconnected to your current one. Credit Unions are great since they usually have no fees and a very low minimum balance.

Don’t get a debit card or ATM card connected to this new account, and don’t download the bank’s app. You want to make it as difficult as possible to get to this money.

Clean Your House

This tip serves two purposes. First, it gives you something to do besides spend money. Organizing your closet, cabinets, or basement takes time, after all. But second, cleaning up also helps your home feel more comfortable, warm, and inviting.

One of the big reasons we spend money out at restaurants, movie theaters, and other amusements is because we don’t want to be at home. Home feels boring, gross, and uninviting.

Change that by sprucing things up! You can simply do a surface level clean (which for some people might actually be a serious project), or you can do a deep clean. If you really need a change, you can also rearrange all the furniture. It’ll be like coming home to a new place every night!

Estimated savings: $500

Yeah, you might spend a few bucks to buy a new bottle of vinegar or Febreze. But if it keeps you home for even half of the weekends in the next six months, that’s a win! If you’d usually spend $50 on drinks, food, or entertainment during that weekend, you’ll end up saving $500.

Hold a Yard Sale (In-Person or Virtual)

You’d be shocked at the things you have just lying around your basement, storage unit, or car that you’re not using. That air fryer Aunt Janie got you last Christmas? Your high school algebra notes? Awesome clothes you’ll never fit into again? You can sell those!

There are websites out there to help you sell virtually anything. Used clothes, electronics, DVDs, study notes, books, collectibles, toys, even toiletries from couponing stashes. I won’t give any suggestions, however, since I’ve never had as much success with these.

Instead, I tend to use Facebook Marketplace, eBay, or Craigslist for online selling. I’ve noticed craigslist (at least in my area) is still the domain of older men, so if you have any tools or car equipment to sell I’d definitely post there. Otherwise, I’ve had more success selling kids toys, any clothes, entertainment items, and small appliances on Facebook Marketplace. EBay is useful for specialty items, collectables, and other rare things that might not appeal to local people.

If you’re going to have an honest to goodness yard sale, you can still make good money, especially if you pick a good weekend in the warm (but not too hot) season. Furniture is the biggest seller, followed by old games, artwork, costume jewelry, and camping gear. Make sure you display everything well; people don’t want to hunt through huge bins to find what they’re looking for. If you can, hang up clothes. Finally, have everything clearly labelled.

Estimated savings: $500-1000

According to the New York Times, the average yard sale can net $500-1000 in a single weekend. We know, however, that you can make even more by selling to the right people. Online selling can make you much more money if you find someone who knows how valuable a mint condition Charizard card is.

Go Zero Waste

If you spend a small fortune on paper plates, napkins, paper towels, plastic wrap, aluminum foil, or other disposables, stop! All of those things can be replaced with reusable items that you never need to buy again (or far less frequently). Try a real set of plates from the thrift store, a set of reusable napkins, and rags from old clothes or sheets. You can always go back to disposables if you want after 6 months.

Estimated savings: $230

With normal use, most people can spend around $230 over the course of six months on these kind of single use items. If your family has a lot of klutzes, small children, or pets however, you might spend double that just on napkins or paper towels. Now that’s how you save 5000 in 6 months.

Flip Things to Save $5000 in 6 months

You could try flipping over your couch and looking for spare change, but you know that’s not what I mean. People are always trying to get rid of things that are half broken, out of style, or otherwise worthless (to them). You can find things like this while thrifting, at yard sales, and even on the side of the road. If you have any kind of handy skill however, you can take what others don’t want and flip it! Improve it with sewing or tailoring if you know how. Or use your mechanical, technical, carpentry, or even upholstery skills to improve the value of things. Heck, even just a bit of elbow grease can make old, dirty things sparkle and instantly become more attractive.

Once you have everything looking nice, look at places like Craigslist, Facebook Marketplace, or even open up a mini-business with its own social media. Then get busy selling!

Estimated savings: $300-600

If you start with a goal of flipping just one thing a month for around $50 each, you’d net $300 by the end of six months. This would mean focusing on things like small appliances, kid’s bikes, or upscale clothing.

If you want to aim for making $100/month on flipping, that’s $600 saved total. Things like bigger toys, furniture, or some smaller electronics are more for this range.

So that’s how to save 5000 in 6 months, chart included. If you’d like to see more frugal living tips, join my newsletter below to get exclusive tips every month!